Maybe I’m just being targeted with more card offers, but between my experience and research for a small payments project, I’m seeing more crypto companies roll out traditional-looking cards. It’s a smart strategy: crypto is still cryptic, so familiar packaging becomes a Trojan Horse into the market. People have been talking crypto-card growth spurts for years (see i2c in 2022), and some still call it a slow roll, especially after multiple “crypto winters.” However, it feels the pace is picking up, so I dug in and wrote up why.

What’s changed? This article is my take, part as crypto enthusiast, but mostly through a strategic product lens. The bigger picture is an industry that’s enjoyed near-unchallenged dominance for decades, and suddenly the landscape is getting complicated. Card networks remain entrenched, but the last few years added simultaneous pressure from regulation, real-time bank rails, and shifting consumer payment preferences, making the ecosystem materially more complex. It may look like the upstarts cooled off as the hype faded. I think that’s a dangerous assumption and a setup for surprise. Let’s look at what’s been happening and why I believe we’re closer to new inflection points than ever.

By the way, this isn’t a prediction that revolving credit disappears. Many find value in it regardless of how destructive it can be to personal wealth. This is more a prediction that the card bundle (payments + rewards + account relationship) shifts to wallets, leaving traditional issuers with less pricing power.

TL;DR Spoiler: You don’t have to do anything just yet. Though you may want to explore as a consumer to see if you can get better rewards. As a merchant, just keep an eye out for evolution here. Customers may abandon shopping carts or avoid you if you don’t offer their payment method.

That’s it. Stop right here!

However, I believe in deeper holistic and strategic marketplaces views. So if you want the long form in-depth reasoning, here you go…

Credit cards? Crypto cards? What’s the difference?

In your wallet they can look identical; on your phone they might all look the same too. The practical difference is what money you’re spending (a bank credit line vs. cash/stablecoins/crypto) and what “rewards” really are (points vs. tokens vs. yield-like incentives). Most crypto cards today are debit or prepaid and still run on Visa/Mastercard rails for now. That matters because disruption doesn’t have to mean “replace Visa/Mastercard/AmEx” overnight. It can mean capturing the customer relationship, the rewards economy, and deposit balances, making the legacy model feel (and become) overpriced if the new options keep delivering real benefits. Some crypto rewards will disappoint; others may beat what banks offer. And if rewards are paid in stablecoins, the risk can be relatively low. What are you trading off? Some airline miles and a $25 gift card after a year of spend?

Yes, there’s a massive installed base behind cards. We have terminals, processors, service layers, but merchants have been captive for a long time and don’t love card fees. If better options show up, many will take them. The issue is the chicken-and-egg problem: merchants won’t add “yet another payment method” until enough customers use it. And the real savings only show up once you can bypass the high-cost toll roads, not just bolt onto them. Visa and Mastercard are experimenting with crypto cards, but those transactions still ride expensive networks. Even now, as Artemis notes, most crypto card volume settles via fiat rails, and the big structural shift is the rise of “full-stack issuers.” Artemis also argues direct stablecoin acceptance has a brutal bootstrap problem. Maybe. But for how long? History favors challengers who surround incumbents from the edges. The gorillas are too big to encircle quickly, and challengers aren’t coordinated. But if enough of them keep pushing from below, isn’t it eventually a matter of time?

Why Crypto Cards Will Disrupt Traditional Credit Cards Soon

Crypto hype cycles deserve some ridicule, but the noise hides a few real dynamics. Yes, this has been building for years. That’s the point: we’re now at or close to an inflection because the rewards value is increasingly there and the onboarding pain will lessen over time.

Lack of Pain Points for Most of Us is Not Lack of Pain Points Globally

Still not convinced? Shift perspective. If you’re a well-paid professional with a solid credit score, credit cards already work and you probably pay in full. But billions live where credit is thin or predatory, currencies are unstable, cross-border spending is expensive, banks are slow or exclusionary, and in extreme cases people may need to relocate quickly due to unrest.

In these cases, stablecoin-based crypto cards can feel like a first real “credit card moment.” Estimates put the unbanked at 1.3 billion globally (some say 1.7 billion); even in the U.S. it’s up to 6%. Definitions vary. Many rely on fintech alternatives rather than traditional accounts. Some 60% of Gen Z don’t have a traditional bank account. When it’s not by choice, the substitutes can be costly (check-cashing, payday loans, “banking deserts”). If legacy fees stay high, these users won’t embrace stablecoin payments on old terms. As James Smith notes, cross-border payments can still cost 6–10% and take days; cards are simply a visible, easy use case for consumers to try these new rails.

How Will This Accelerate?

It’s the usual pattern: slowly for a while… then all at once.

Payments adoption isn’t a viral app. It’s trust + distribution + habit, and switching takes real effort. But once a new payment bundle is “good enough,” momentum can compound because merchants don’t want to lose sales (or margin), consumers follow rewards and convenience, and ecosystems; wallets, payroll, remittances, apps, all start to interlock.

This is also an area where consumers may be less satisfied than they tend to think about. They’ve adapted to a familiar menu of options. Cash is a fallback, but it has real costs and risks, and some merchants stopped taking it (COVID gave cover for “cashless”). That raises fairness issues. Legally, “legal tender” for all debts public and private matters once a debt exists, but many purchases aren’t “debts” until you agree to the sale, so merchants can say no cash. Though some jurisdictions still require cash acceptance. Possibly because in practice, refusing cash can also function like redlining against certain customers.

In developed markets, the hurdle is switching friction: the new option has to feel meaningfully better. Some people cite a “10x better” rule of thumb, but it’s not just the pull of “better”, it’s also the pain of feeling trapped. Many customers “satisfice”: they stick with what’s just above the usefulness threshold because changing autopays and habits is a hassle. What changes the game is when an alternative feels like relief. “Finally, I’m out of that relationship.”

U.S. adoption gets a lot of attention, but the leading edge of new options sometimes shows up in emerging markets and that’s telling. Juniper Research reports Latin America crypto adoption surged 63% in 2025. Pair that with extreme inflation (Argentina is the obvious example) and it’s not surprising to see meaningful crypto-payment usage. Incumbents are trying to adapt, but can they really “eat their own business”? Strategy history is full of firms that couldn’t. Christensen’s Innovator’s Dilemma is the classic warning, and I suspect we’ll see some wreckage. As strategist Alex Smith puts it: “In my 15 years doing strategy, I have learned 1 thing: People *hate* to change. They hate to be proved wrong. They hate changing how they do things. They hate stepping into the unknown.”

That resistance is exactly what can slow incumbents from adapting as fast as they might need to. Maybe some will learn the lesson in time. Either way, the competitive landscape is shifting.

Seeing is Believing

Sometimes you have to see to believe. Other times you have to believe to see. With money, it mostly comes down to social trust. Most people don’t understand how money works; they understand:

- “Does my payment get declined?”

- “Do I get fraud protection?”

- “Do I get points?”

- “Does it make my life simpler?”

Crypto cards only need to win on those practical outcomes, not ideology. Early crypto leaned heavily ideological; “maxis” still argue about TradFi co-opting DeFi. Normies don’t care. They care about jobs-to-be-done: does it work in stores and online, does it feel safe, does it pay better rewards, does it cost less. And more companies are now pushing hard to close the gaps that made the status quo feel like the only rational option. Plus they’re finally investing in marketing and clearer messaging to overcome leftover hype-cycle baggage.

Initial Disappointment is Normal (And Instructive)

A lot of early crypto cards leaned on token rewards that looked incredible in bull markets and depressing in bear markets. If you earned rewards in a volatile token, your “cash back” could become “cash… evaporated.” That wasn’t a fatal flaw in the concept. It was a flaw in the reward denomination and the business model maturity. Token rewards may still be a valid draw, but only with more rational options and less sensational claims.

I got a Crypto.com card in 2020 partly to experiment, and yes, partly because the metal card felt cool. But the real motivation was CRO rewards. It was also convenient when Costo went to Visa as it worked to get the hotdog deal. Now that’s motivational. More seriously, the math looked better than tiny points programs, until crypto winter hit. And stayed. I accepted the risk, but today there are more options that don’t require that level of commitment.

What’s Changing Now?

Here’s the core thesis: crypto cards will increasingly compete on cost, rewards, and product design because stablecoins + modern wallets let companies rebuild the economics of cards. Incumbents are playing too, but it’s worth asking how much is real strategy vs. a defensive grab using stablecoins for internal efficiency while keeping customers on their rails. Mastercard’s partnerships (OKX, MoonPay, Kraken, etc.) fit that pattern: watch, learn, intercept value, keep control. That can work for a long time. After all, some people still have cable, but cord-cutting shows what happens when younger cohorts simply don’t buy in. That might be a wholly different industry, but the metaphor seems aligned in terms of consumer behavior pattern probabilities.

You can smell the pattern in other industries: incumbents try to “embrace” disruption without changing the business model. A lot of customers aren’t loyal. They’re just sleepwalking with whatever is good enough because switching is annoying. Then something clearly better shows up and the inertia breaks. Some merchants already signal the difference with “cash vs credit” prices. If a cheaper, easy alternative becomes real, many will promote it. Once they do, the window stickers for what payment methods are available can change fast.

Stablecoins Should Make “crypto spending” Feel Like Normal Money

The killer feature isn’t spending DOGE. It’s spending stablecoins. Digital dollars that move cheaply, settle fast, and integrate with apps. That enables simpler cross-border spending, “dollar banking” outside the U.S. (a whole other debate), and faster movement between saving, spending, and investing balances.

As James Smith puts it, stablecoins can act like a “Currency API” for moving value over the internet. That foundation is strengthening: a permissionless rail that can route around older systems. Gateways and tolls won’t vanish, but costs can drop sharply. One or two percent seems small until it’s applied to trillions. That’s real money in trapped value that gets redeployed somewhere else in the economy.

Lower Cost Structure (sometimes) Creates Better Economics

Traditional card economics are a tangle of interchange, network fees, issuer costs, fraud/chargebacks, and rewards subsidized by interest and fees.

Stablecoin-based money movement can reduce costs for certain flows, creating room to compete via better rewards, lower fees, improved FX for travel/cross-border, and new bundles (instant transfers, programmable savings, on-chain yield where appropriate).

Key nuance: many crypto cards still use legacy rails at checkout, so near-term disruption is often back-end economics plus ownership of the customer relationship, not immediate replacement of card networks. This is partly why Cryptomint argues that crypto cards vs. credit cards isn’t even the right discussion, because the real issues are behind the scenes. They say “Stablecoins are fundamentally competing with ACH and SWIFT as money movement infrastructure.” This may be true, but this doesn’t mean that credit cards aren’t still at risk. They also point out, “here’s what they sacrifice: all consumer protections. No chargebacks. No dispute resolution. No fraud arbitration. No Zero Liability Policy.” However, this is part of my point. Isn’t this likely temporary? There’s nothing about these benefits that can’t be replicated. Or at least mitigated. This might not be easy. But doable. The newer companies will spool up to such services. And yes, that means increased costs, but they’ll likely still be able to do so at lower cost than incumbents.

Maybe I buried the lead here, because part of the more full benefit of “more pure” crypto cards will be once payments are all way off traditional network payment rails. This, however, is the part that will be more challenging and take longer. However, what’s happening now feels like more of a bridge.

Rewards Get More Flexible

Traditional points are a closed loop. Crypto rewards can be paid as tokens (with volatility risk), stablecoins (closer to cash back), boosted rewards tied to behaviors (holding balances, direct deposit, subscriptions), or partner rewards that can be traded, staked, or used across ecosystems.

The bigger idea is portability: rewards can become real, moveable value instead of points trapped inside one issuer’s mall. You can already see the broader trend. AI, crypto, and others building their own marketplaces/exchanges because “a small take rate times millions of transactions” is still a beautiful business, even if it becomes further commoditized and the percentage take rate is less. If payments and rewards get more open and commoditized, the competitive dynamics get interesting fast. Large incumbents don’t want to give up margins, but smaller upstarts will happily live on the “crumbs” of millions at lesser rates. I don’t think incumbents are yet at the point where “they’re up to their tails in alligators, and they’re draining the moat” yet. But the keyword is “yet”.

Debit Can be “good enough” for a Lot of High-Income Users

Many high-income users already treat credit cards like a payments UI: they auto-pay in full, keep liquidity elsewhere, maximize rewards, and avoid interest.

For them, the “credit” feature matters less than rewards, fraud/purchase protection, clean tracking, and status perks. If crypto cards can match protections and UX while improving rewards or flexibility, “debit vs credit” becomes less decisive. Especially as more people keep large balances in high-yield cash alternatives.

And yes, there’s an uncomfortable subsidy dynamic: people who pay in full often get perks partly funded by “revolvers” who carry balances and pay high interest over time.

Regulation and Fee Pressure Can Squeeze the Old Perks Model

A lot of premium perks are funded by a mix of interest, fees, and merchant interchange, with rewards concentrating on prime customers. If regulation, competition, or consumer shifts compress those revenue streams, the traditional rewards arms race gets harder to sustain.

Crypto-native players, especially those with other monetization levers (spreads, subscriptions, exchange services, deposit balances), may be better positioned to keep rewards attractive even as legacy economics tighten.

Programmable Money as Superpower?

This is the part most people ignore until it’s everywhere, and yes some of it is still early-adopter territory. Think: salary paid in stablecoins (or instantly converted), automatic splitting into bills/savings/investments, and embedded finance inside apps and communities. Add AI-driven wallets that personalize spending, like auto-converting rewards based on behavior, and the “card” becomes just one access method to a broader wallet-based financial operating system.

Some Candid Caveats

Crypto cards aren’t automatically better. The risks are real. At least for now.

- Reward volatility: token-based rewards can drop fast. Prefer stablecoin or transparent cash-equivalent rewards if you hate surprises.

- Fees and spreads: some programs hide costs in conversion spreads or withdrawal fees.

- Changing terms: crypto card rewards can be generous… until they aren’t. Programs change often.

- Custody risk: if the provider holds your funds, you’re taking platform risk (not the same as a bank account).

- Taxes: depending on where you live, converting crypto to spend may be taxable; stablecoin spending is usually simpler, but don’t assume “no paperwork.”

- Protections: credit cards often have stronger consumer protections than debit.

This doesn’t kill the thesis. (Or so I tell myself anyway.) It just means disruption will come from the best-designed crypto cards, not “any card with a token logo.”

When?

I cannot give you a date. I won’t even guess at one. It’s a transition period.

Okay fine… I’ll throw a dart. I’m going to say that somewhere between early 2027 and 2028, this becomes a huge story and a tipping point. Why? Because the so-called Tipping Point is usually around 30%. Note that 30% is not a number from author Malcolm Gladwell. It’s more a general sense. Look at Everett Rogers’ Diffusion of Innovations where Rogers describes an S-curve adoption pattern. The “tipping point” or point of self-sustaining growth often occurs around 10-25% adoption. Then there’s ideas about network effects and social contagion models and studies on social norms. Critical mass for self-reinforcing adoption can range from 10-30%, depending on the context.

I can imagine getting there on card deployment (and maybe volume) by then, even if some charts suggest 2028–2030. There’s too much money chasing this, and it feels like the pace is increasing. Data matters, but so does pattern recognition.

The better answer is: watch for these signals:

- Stablecoin usage keeps growing in everyday finance (I’m not talking about trading; I mean day-to-day transactions)

- More employers/payroll apps support stablecoin rails, (this will likely accelerate first with international transfers and payments because it’s such an obvious and valuable use case which is already happening)

- Crypto cards standardize strong consumer protections

- Rewards shift from volatile tokens to stable, sustainable value

- Mainstream banks start offering “wallet-like” features to keep up. (This is already happening.)

Disruption often looks invisible. Until it’s not. The growth of consumer AI has been both fast and highly visible. This area in finance? Slower. And more slowly embedded until it’s more ubiquitous.

One of the biggest drags may not be tech. It’s taxes. In some places, using crypto for everyday purchases can trigger capital gains on each transaction (unless you stay in stablecoins). Even if enforcement is uneven, the confusion and fear are real. Stablecoins reduce that friction.

What Should You Do

As a consumer, maybe nothing. “Wait and see” is valid. You’re not missing some massive edge. If you’re curious, start slowly. If you’re worried about systemic risk, maybe you want Bitcoin exposure, but remember: stablecoins track the dollar. (Down as well as up or sideways.)

- Don’t replace your best credit card yet. Add a crypto card as a secondary card first.

- Prefer stablecoin-denominated rewards (or cash-equivalent) unless you explicitly want token exposure.

- Check conversion/spread fees for spending, ATM, and FX.

- Confirm protections: fraud liability, chargeback handling, purchase protection, and support quality.

- Limit stored balances to what you’re comfortable with on a non-bank platform.

- Use it where it’s strongest: travel FX, budgeting, rewards stacking, or as a bridge into a wallet ecosystem.

Just have a practical mindset. Think of a crypto card less like “I’m betting on crypto” and more like:

“I’m testing a new financial tool that might make payments and rewards more efficient.”

As a merchant, pay close attention to this area and be ready to adopt things like this before customers choose to not shop with you because you don’t offer their preferred payment method. Abandonment based on this issue varies by demographic, but it’s a non-trivial thing. PYMTS says, “70% of Shoppers Say Payment Options Influence Where They Shop Online.” There’s also data regarding abandonment when a preferred payment method is unavailable.

Conclusion

Crypto cards won’t disrupt credit cards because everyone wants to pay in Bitcoin. They’ll disrupt them because stablecoins + wallets let companies rebuild the economics and UX of spending with lower global friction, more portable rewards, and tighter integration with modern digital finance.

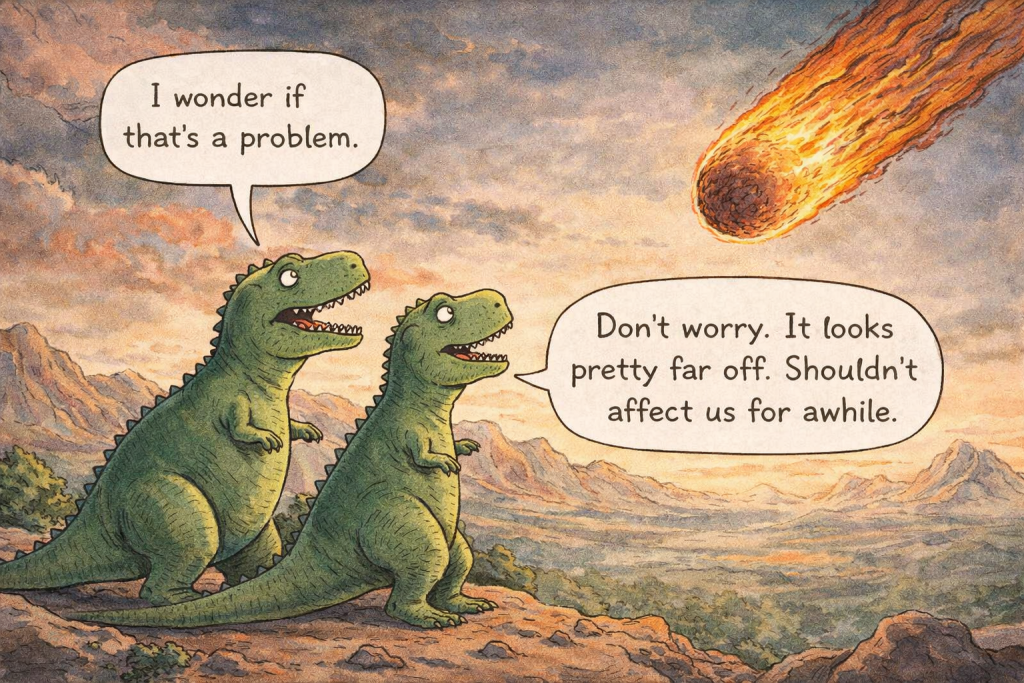

Traditional cards still have real strengths: credit, protections, and trust. But once crypto cards match those while offering better value, especially in a stablecoin-first world, the “default card” could shift faster than most people expect. I don’t think incumbents are standing still; they’re clearly responding. But if there’s any sense that everything is fine for a while, that confidence may be misplaced.

See Also:

- Best Crypto Cards in 2026

- 10 Best Crypto Credit Cards With Spending Rewards in 2025

- Crypto Cards Ranked: Which Ones Are Actually Worth It? (YouTube)

- Crypto Credit Card vs. Crypto Debit Card: What’s the Difference?

- Crypto cards are booming, but what they mean for the future is unclear (American Banker: Paywall article.)

Addendum: Fuller Comparison Chart

| Feature | Traditional Credit Cards | Crypto Cards (Mostly Debit/Prepaid) | Notes / Winner Depends On… |

|---|---|---|---|

| Funding | Borrowed credit line (pay later) | Your crypto/stablecoin balance (pre-funded) | Stability vs. crypto exposure |

| Card Type | True revolving credit | Debit/prepaid (spend what you have) | Credit-building vs. no debt risk |

| Credit Check | Required (score, income, history) | Usually none – just KYC & wallet link | Easier entry for crypto users |

| Spending Flow | Charge → bill later | Auto-convert crypto to fiat at POS | Convenience vs. instant settlement |

| Rewards | 1–5% cash back / points / miles (stable value) | 1–8% in BTC, ETH, stablecoins or tokens (volatile) | Predictability vs. upside potential |

| Rewards Risk | Fixed & reliable | Can evaporate (bear market) or multiply (bull run) | Traditional wins for risk-averse |

| Fees | 2–3% merchant interchange + 0–3% FX + high APR if carrying | Conversion/spread (0.5–2%) + often lower FX; no interest | Crypto often cheaper cross-border |

| Foreign Transactions | 2–3% FX fee common | Frequently 0–1% or none (stablecoin advantage) | Crypto excels for travel/remittances |

| Protections | Strong: zero liability fraud, chargebacks, purchase protection | Weaker: debit-style (funds gone), limited chargebacks, custody risk | Traditional still mostly superior |

| Debt / Interest Risk | High if balance carried (15–25%+ APR) | None – can’t overspend beyond balance | Crypto safer for discipline |

| Tax Implications | Rewards generally not taxable | Spending / converting might trigger capital gains | Traditional is a lot simpler |

| Merchant Acceptance | Near-universal (Visa/MC networks) | Same (while it rides on Visa/MC rails for most) | Tie for now |

| Best Use Case | Building credit, travel perks, buyer security | Spending crypto easily, low-fee global transfers, inflation hedging | Context matters (e.g., emerging markets) |

| Biggest Drawback | Debt trap if mismanaged | Volatility + weaker protections + platform risk | Winner depends on holder / context |