As a product person and retail investor, I’m sensing what I would have thought is an obvious risk with Real World Assets (RWA) tokenization, but don’t see much discussion beyond esoteric finance venues. I’m a believer in blockchain and crypto opportunities. However, I prefer a more thoughtful approach than the breathless crypto maxi hype spew. With that perspective, I’d like to offer a primer for product managers and investors interested in this area. I’m trying for a deeper sense of what’s going on than, “The RWA Tokens Are Coming, Invest Before You Miss It!” Or as Darth Crypto would say, “The FOMO is Strong with This One.” Disclaimer: I’m not a finance person… these are my explorations into this world as a retail investor and digital product builder. I’d just like to help my friends and colleagues with informed choices.

Why Should You Care?

As Real World Asset (RWA) tokenization surges, tools promising efficiency and liquidity may also be quietly rebuilding leverage webs that once crashed the global economy. You might say, “So? I don’t use or care about crypto.” Or as a product person, “My product doesn’t involve that world.” You might not have cared about real estate derivative investing either, yet failure of Collateralized Debt Obligations (CDOs) trashed the economy in 2008 due to over-leverage of bad assets. People far from finance were affected when the bubble burst because financial instruments were deeply intertwined with the global banking system. Basically, complex, opaque financial structures can create systemic risk impacting everyone, not just direct participants. I’m not sounding any apocalyptic alarms or worrying about some crash tomorrow. This is about protecting yourself or your products and being as well-positioned as you can be, just through awareness and rational assessment of what should be foreseeable risks. Though on the other side of things, one could argue many private markets are already opaque and tokenization could force more transparency.

What Are Tokens in This Context

Real World Asset (RWA) Tokenization is the process of representing asset ownership or rights on a digital ledger, typically blockchain.

Tokens represent things. A postage stamp can power a system to send a letter. Your frequent flier miles are tokens. So are your dollar bills. Your house… well, not really a token. But your deed is. Sort of. At least conceptually in that it’s a legal document that stands for something else; the same as your car title represents vehicle ownership or an event ticket grants access. What if you could split these up into 100,000 parts? Okay, maybe no one would care about your house, (except perhaps as a bundle just as today’s mortgages), and deeds will likely be tokenized one day. Let’s try with a local shopping center though. Co-ownership happens now, but investing in this asset might be challenging without special access or a large buy in. (For real estate, this is kind of like a REIT, only more targeted; REITs are also regulated entities.) With tokenization, many investors could participate as fractional owners. Maybe you could own 1/10,000 of a Picasso. And so on. For a more extensive dive about tokens, see Demystifying Crypto Basics through Metaphor. And Token Economy: Third Edition, by Shermin Voshmgir. Also, note that “things” can be somewhat transitory, e.g., consumable commodities and utilities (energy, water, bandwidth, etc.) qualify. They’re real, measurable commodities with market value. But for perishables and consumables, this means the tokenized representation must be dynamic, tied to flows or rights rather than permanent ownership.

Benefits of Tokenization

If you’re thinking, “This doesn’t sound new. I buy stocks and those are fractional ownership. Besides, haven’t ETFs, REITs and similar been fractionalizing assets for years?” All true. But now we’re talking about breaking up just about anything. By fractionalizing assets into smaller, affordable units everyday investors can own a piece of premium real estate and other assets previously out of reach. (That’s the theory anyway. This asset type is still not quite a general retail thing.) This enhances liquidity for illiquid markets, enabling 24/7 global trading on blockchain platforms with reduced transaction costs and faster settlements. Blockchain ledger transparency provides auditable ownership trails, while smart contracts automate processes like dividend payouts or compliance checks, minimizing counterparty risks and fostering composability with DeFi protocols for innovative financial products. This could unlock trillions in trapped value, creating a more inclusive and efficient economy. As of mid-2025, the RWA market has surged to between $23 billion and $30 billion in tokenized assets, marking a 260% to 400% increase from levels under $10 billion in 2023 and around $5 billion in 2022.

Fast History

Tokenization is another years-in-the-making thing, now rapidly evolving from speculative into mainstream financial movement. By converting real-world assets like real estate, art, patents, etc. into digital tokens, institutions can trade and fractionalize once illiquid holdings. In the past year, banks, asset managers, and fintech startups have accelerated RWA tokenization pilots, touting potential to expand access, improve liquidity, and cut transaction costs. BlackRock’s tokenized fund initiatives and rise of platforms offering tokenized Treasury bills show institutional adoption is no longer theoretical. Though it’s worth noting the typically technically forward U.S. is behind here. Top UAE based crypto lawyer Irina Heaver literally laughed out loud in an interview when asked about recent U.S. efforts. It didn’t seem to be intentional mocking at all; just an honest spontaneous reaction. The U.S. is catching up, but slowly and unevenly. Just be aware the U.S. and worldwide regulatory frameworks for this sort of thing are still quickly evolving. (E.g., unlike Dubai’s VARA, the U.S. still has overlapping definitions and inconsistent treatment across agencies.)

How It Works

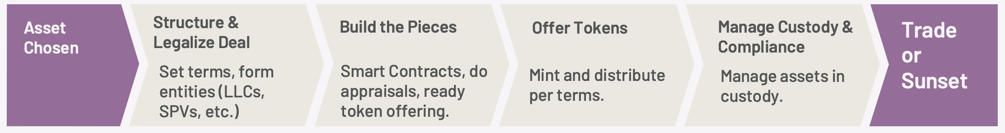

Tokenizing a real-world asset like a building involves converting ownership rights into digital tokens on a blockchain, typically through a Special Purpose Vehicle (SPV) likely formed as an LLC, which holds the property’s title. Technically, it doesn’t actually have to be on a blockchain vs. other ledger types, but practically speaking, it’s most likely. The process includes appraisal to establish value, forming the SPV to legally isolate the asset, designing security tokens (e.g., ERC-1400, evolving to ERC-3643 and ERC-7943) with smart contracts to automate governance and payouts, ensuring compliance with securities regulations, and minting tokens for investor purchase, often verified by oracles like Chainlink. This enables fractional ownership, enhances liquidity, and ensures transparency. Though it requires legal and technical safeguards to prevent fraud or mismanagement. Once done, people can buy/sell/trade the tokens. There’s a whole cottage industry to help with the process.

The Risks

I’m not the first to express concern. However, I’m trying to emphasize the need to more carefully consider risks of cascading consequences. You’re likely familiar with the idea of Black Swan events, popularized by Nassim Nicholas Taleb in “The Black Swan: The Impact of the Highly Improbable.” Are some problems truly that improbable? Maybe we miss things because we’re blinded by fever dreams and FOMO in the frenzy for yield. And let’s not forget there’s folks crafting new leveraged yield-bearing products. Where better to do that than shadowy places with incomplete regulatory coverage. What might happen when everybody gets to play? Maybe re-read the classic, “The Spider and the Fly” By Mary Howitt (1829). Or at least the first line… “Will you walk into my parlour? said the Spider to the Fly”

Yes, there’s amazing opportunity here. Still, caution is a fair middle-ground vs. head first dives into sometimes murky water. As RWA tokenization drives financial efficiency, we should at least see a warning light. The more abstracted assets become, as small slices of large assets can be pledged, re-pledged, or bundled, the more difficult their true risk is to discern. The web of obligations might outgrow transparency. Tokenization’s promise of fractional ownership and liquidity can enable leverage at unprecedented granularity. (See thoughts on leverage: International Organization of Securities Commissions (IOSCO), March 2024 – March 2025 Workplan.)

Also consider “composability.” Banking, finance, etc. used to be monolithic institutions with rules and workflows. Now they mix and match technology capabilities. Composability is seen as a good thing allowing more creative finance. However, there’s a great line in Section 7.2 of the May, 2025 WEF Insight Report, “Asset Tokenization in Financial Markets: The Next Generation of Value Exchange” that says, “Controlling the Limitless Nature of Composability.” Therein lies the potential for cascade challenges. With systems deeply intertwined, shock in one corner of the market could cascade across multiple networks before regulators or participants even see the exposure. Liquidity mismatches, where instantly tradable tokens represent slow-moving, illiquid assets could amplify the pain. (See The Financial Stability Implications of Tokenisation, Section 3.1.)

There’s many risks. Here’s my assessment of the top four:

- Rehypothecation and Leverage Build-Up: Composability where tokens are combined or reused in smart contracts makes it simpler to rehypothecate assets as collateral. This could amplify leverage as underlying assets might be pledged repeatedly without adequate safeguards leading to excessive borrowing and potential chain reactions during market stress.

- Liquidity Mismatches and False Perceptions: By dividing illiquid RWAs into small, tradable tokens, fractionalization creates an illusion of liquidity that may not hold in downturns. Investors could demand redemptions via 24/7 trading, forcing fire sales of underlying assets and triggering price spirals, exacerbating systemic shocks, especially if automated smart contracts force mass liquidations.

- Complexity Hiding Risks: As assets are abstracted into layered tokens and smart contracts, risk becomes obscured, much like how collateralized debt obligations (CDOs) masked subprime risks in 2008. Dependencies on third parties (e.g., oracles for pricing data) or complex programmability could introduce vulnerabilities like hacks or mispricings, leading to divergences between token values and real assets, and amplifying interconnectedness across platforms.

- Lack of True Ownership: Tokens for RWA are not necessarily ownership. You won’t likely have actual possession of anything and your legal recourse will be minimal. (Your tokens likely represent economic rights, not direct title.) Legal ownership is off-chain, governed by contracts rather than blockchain entries. Governance, voting rights and legal title will be things over which you likely have little control. It’s not nearly so much property rights as your delegation of management to others through a platform. Others will control actual custody and managing physical assets. This might be fine. Or be incredibly dangerous. The point is be even more careful about what you buy or place in these new venues. And in the case of real estate, I’ve completely left aside the many issues of basic risk and fraud before we even get to the tokenization part. Just wait until we get to tokenizing new things.

Risk Mitigation

Advocates argue this time is different. Blockchain can, in theory, provide transparency. Every transaction, every pledge visible in real time. Programmable constraints could enforce collateral limits, prevent double-pledging, and trigger risk controls. Regulators could monitor systemic exposures. Those are advantages over opaque derivatives markets of the past. But theory doesn’t always survive contact with profit incentives. Wherever leverage is possible, it will be used.

What Can You Do?

Take care. You don’t need to buy tokenized assets to be exposed to them. Even if standing to the side, watch your allocations and counterparties. If you are participating directly, can you check custodial structure to see who holds an asset behind a token? If it promises returns, check if it’s rehypothecated somewhere and risk from the deeper layer. Are there external attestations about the reality of the asset?

The takeaway is not tokenization is bad. It’s that abstraction and leverage demand scrutiny. Before buying in, consider how and where underlying assets are held, whether rehypothecation is permitted, and what safeguards exist if collateral chains start to unwind. Even if blockchain brings more transparency, systemic risk can still accumulate quietly beneath layers.

For product people, make sure to trace dependencies if your product touches tokenized assets. Check both direct connections, and anything via API or agentic workflows. The real fun may begin when more AI agents get their own crypto wallets and start autonomously moving tokens. (You probably see some parallels between crypto derivatives and agentic workflows in terms of dependency chain risk, right?) Though I suppose it may also be amusing to see how general investors value a 1000th of a Picasso vs. an Ape NFT. Sure, we can see this now by just backing into dollars, but that doesn’t have the same feel as seeing all such things on the same leaderboards. In any case, if there’s an ability to use tokens as collateral or staking, make sure you know where the assets are flowing. And make sure to keep up with regulatory issues. Tokenizing everything seems on the way. At which point, TradFi likely all but completely swallows DeFi whole. Whether as an investor considering a position or a product person evaluating a highly interdependent workflow, we should try to have a sense of what interconnections might impact outcomes.

References:

What is RWA (REAL World Asset) in Crypto? (YouTube)

Tokenized Stocks, Stablecoins & Real Estate – The RWA Surge! (YouTube)

BlackRock CEO Larry Fink: We’re at the beginning of the tokenization of all assets (10/14/25) (YouTube)

Tokenization and the End of Direct Ownership: A Quiet Revolution (YouTube)

From ripples to waves: The transformational power of tokenizing assets

Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks

Asset Tokenization in Financial Markets: The Next Generation of Value Exchange

‘Code as Law’: The tokenization of financial assets and the paradox of programmability

The Financial Stability Implications of Tokenisation

Asset Tokenization Statistics 2025: Real Numbers Powering Tomorrow’s Finance

Tokenized Real-World Assets Market Surges 260% in H1 2025

Real World Asset (RWA) Tokenization Could Reach $30 Trillion by 2030

Real-World Asset Tokenization Market Has Grown Almost Fivefold in 3 Years

Releasing Trapped Value: A Playbook for the Age of AI, by Geoffrey Moore