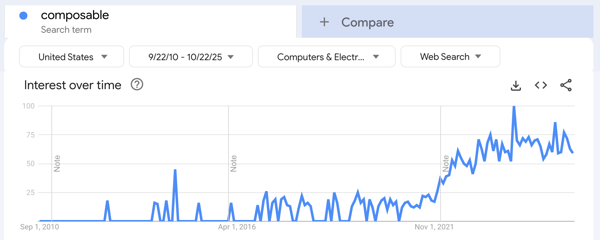

Something is happening across technology sectors creating one of those paradigm-shift moments. It’s not a single breakthrough but a convergence of pieces that have struggled to be the “next thing” on their own. Their larger use cases are emerging as they interact. Look across our shiny new tools: blockchain, crypto, and of course AI and more agentic systems. Together they’re forming connective tissue among themselves. Like generalized microprocessors once enabled hardware to be more useful and economical with flexible software, this new phase of composability could again transform speed, flexibility, and cost.

In Decentralized Finance (DeFi), “Composable Finance” is emerging; assembling bits of financial capability in new ways, often powered by crypto or blockchain infrastructure. Crypto’s growth has spawned protocols enabling DeFi, though cryptocurrency and token use remain messy. Real World Asset (RWA) tokenization may change this, if it proves staying power beyond this year’s hype. Despite lack of common offering marketplaces, DeFi’s composability is serving as a bridge to broader digital modularity.

Bringing the Pieces Together

Finance composability paired with rising agentic workflows drives a mindset shift toward atomicity and composability. Its traction stems from more understandable use cases and components like tokenized assets, oracles, decentralized identity, and AI agents calling smart contract functions via blockchain transactions. These pieces contribute to suggest more “Composable Everything” capability.

Yet this is only part of the story arc. Zoom out: it’s a new industrial revolution for digital, reshaping software, business processes, and product capabilities. How pieces mix, match, and monetize will redefine value creation and payment flows.

Composability Beyond Finance

Composability predates crypto, but DeFi popularized it in tech culture. Now it can further permeate software architecture and business models. “Composable everything” means breaking monoliths into modular components for rapid adaptation. This idea isn’t necessarily new, yet finance’s modular smart contracts give examples of how to accelerate it elsewhere: AI workflows, supply chains, reusable logic.

Dismissing these changes as just modular software that’s similar to what we’ve had for decades misses the step-change in granularity. Four of the most dangerous words in business and tech might be “It’s different this time.” Still… this is a new level.

The pattern suggests deeper modularity everywhere. See “Composable Business 101” for one perspective. Also, “Composable Software in 2025” and Digital Experience Platforms.

These trends validate the idea: composability is extending, spurring innovation like interchangeable parts in manufacturing. We can add these parts to our APIs and data services and get seamless global transactions in identity, data, payments, more.

Why now?

Why is “Composable Everything” the next big wave? What are the enabling conditions?

- Standardization & open protocols: Token standards enable interoperability. Example: Centrifuge / Maple can link things like tokenized invoices to DeFi pools, bridging off-chain value.

- Programmability & decentralization: Smart contracts turn financial ops into composable code. Deposits, swaps, and loans become programmable, as do supply-chains (VeChain, IBM Food Trust), identity (Civic / identity.com, Polygon ID), and NFT royalties (Audius).

- Modularity in software & cloud architectures: The long shift to microservices, APIs, and modular stacks reduces monoliths and increases reuse, fostering a composable mindset across industries.

- Network effects and ecosystem dynamics: A module’s value grows as more connect to or build on it. This stacking accelerates innovation.

- Agent Tools: Frameworks like LangChain, OpenDevin, and MemGPT chain APIs and actions, turning workflows into composable parts. Visual tools like n8n make it easier for non-coders to build.

- Crypto Payment Rails: Dollars, (or any fiat currencies), are not very flexible. Crypto (Stablecoins / tokens) can be used as payment or access rights or ability to run a data vending machine or… whatever.

- Identity Mechanics: People, machines, and agents need verifiable identities to collaborate. Cryptographically secure means exist, but need better “Root of Trust” services. Root of Trust has often been pitched as a decentralized value in blockchain circles, but in practice, it frequently leans centralized as the decentralized ideal often bumps up against practical realities. This area still has tension, but there are practical solutions and it’s part of the puzzle.

Taken together: the infrastructure, standards, developer culture, and demand for rapid innovation are aligning. The stage might not be completely set, but it’s getting there.

Industrial Revolution Analogies

“Composable Everything” mirrors the Industrial Revolution’s modular, interchangeable parts that standardized production and fueled growth. In digital, modular systems drive the Fourth Industrial Revolution; cyber-physical systems and smart factories. Components self-monitor and adapt. Example: modular robotics enable cost-effective automation for variable demand.

PwC says that by 2030, AI, modularity, and nearshoring will reshape industries. Modular architecture has evolved from Industrial Revolution roots to smart eras, amplified by digital twins. Digital-native firms leverage modular software and structures for speed. Thesis: steam engines revolutionized physical industry; composable primitives will radically accelerate industrializing digital creation.

Potential Impacts

Last week, I took our daughter to a Maker lab we’re lucky enough to have in our city. She did her first 3D print there. She’s using more varied modular learning tools than my generation had. In grade school, kids are coding and producing. They learn how early in games like Minecraft, and directly translate those concepts into 3D modeling tools and robot IoT toys. They’re growing up with modular everything. Mix and match is required. What will product search and branding mean in this kind of a world? Future builders may still code, but will more so compose from more complete simple modules, not just libraries. (Or at least they’ll start this way.)

Implications of “Composable Everything” are profound, democratizing innovation by letting anyone assemble complex systems from primitives. While the term gained traction in DeFi, it’s now extending everywhere.

Cost impact: Higher efficiency, unlocked value. Tokenized supply chains, composable insurance, AI data marketplaces, and automated compliance can free up capital and cut friction. Micropayments, long stalled by high fees, become viable: AI paying for data via stablecoins, GPU compute vending itself. Downstream: data marketplaces with provenance.

Challenges: rollup and appchain fragmentation exists, creating interoperability barriers, but can be solved by composability, creating virtual economies. Result: less redundancy, leaner digital economy.

Value shifts: We’ll sometimes switch from owning pieces to orchestrating them. Banks become composable stacks. What about branding in such a mix-and-match world? Product search turns agent-driven. Solutions could be more on demand: “Build me a finance app,” priced dynamically. How might automated compliance handle regulations? How will consumer behavior change?

I’m suggesting this all leads to a post-scarcity digital economy, where efficiency frees up human creativity, but only if we nail governance (decentralized IDs, ethical AI). We should act / invest accordingly, focusing on primitives and composability, not so much monoliths.

This is my take on this. Agree / Disagree? Anyone else see potential cascade effects of this? That’s what I’m interested in, not just the pieces, but how they come together and what are downstream implications.

Additional Reading

Composability is Innovation

Agents as a Service (AaaS): The Rise of Composable Business and the Art of API Arbitrage

Why the Celestia Team Sees a Future With 10,000 Roll-Ups

Modular Blockchains: Why They’re the Future of Scalability