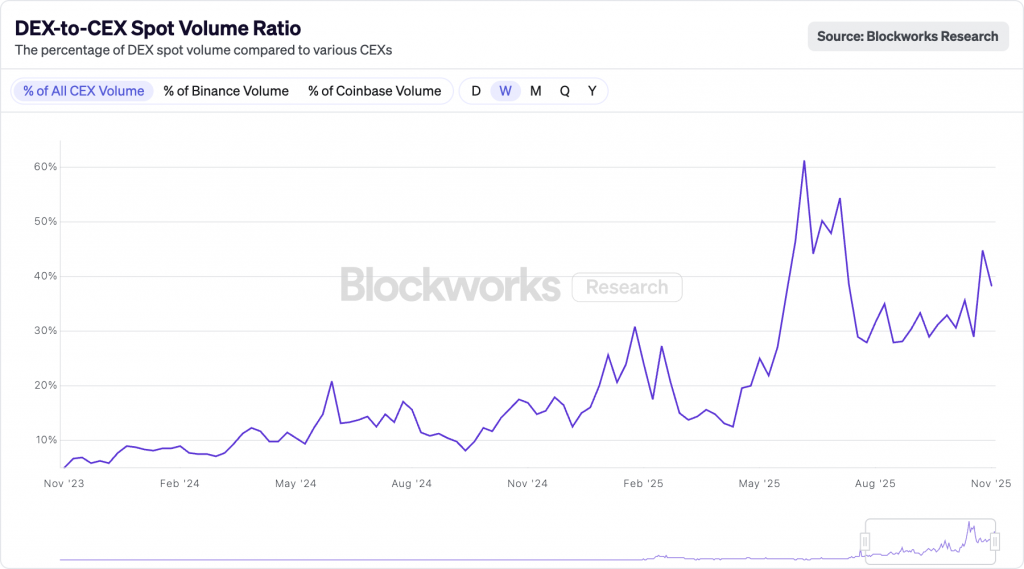

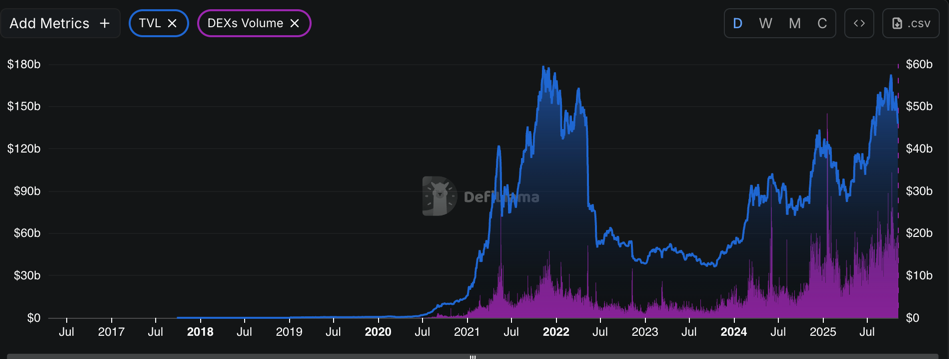

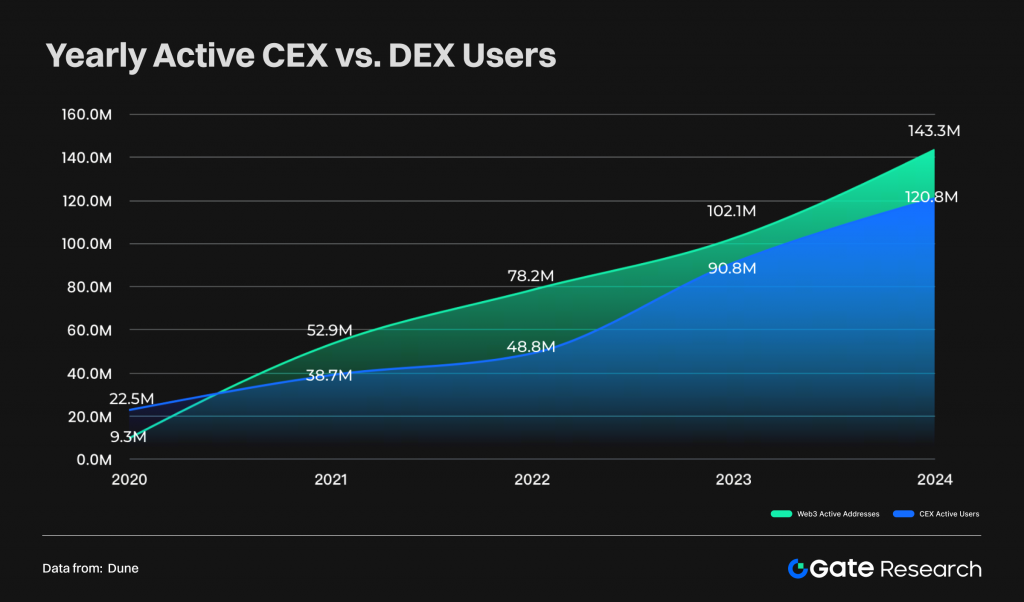

If you follow crypto, you’ve likely noticed the rise in DeFi activity the past several months. As Traditional Finance (TradFi) evolves and co-opts parts of crypto, we’re seeing emergence of a hybrid model called Centralized Finance (CeFi) and watching what may be an inflection year. Every year seems like “the year of SOMEthing,” but with trillions finding new pathways, it seems a fair statement now. Growth of Decentralized Finance (DeFi) despite easier Central Exchange (CEX) options is telling. DeFi remains difficult and risky. Yet it’s growing as percentage of crypto activity. Some of this may be episodic, but it reveals a deeper signal about marketplace pain points: users will endure hardship just to escape worse systems. It’s a story of value over comfort, like drivers taking a pothole-filled detour to avoid a toll road they no longer trust, but there’s someplace they’ve just got to go.

This evolution offers lessons in how product categories evolve; from first-mover to diffusion of innovations. Studied through a product management lens, we might better predict what’s next. It reminds me of the cable cord-cutting story: extra hassle, but people still do it to save money and escape the captivity of the cable companies. The same dynamic may be driving recent DeFi adoption. TradFi frustrates with slow settlement, opacity, etc., but are (CeFit) CEXs for crypto that risky as compared to the remaining pain points in DeFi? Apparently, given growth of DeFi and Decentralized Exchanges (DEXs). Chasing yield obviously plays a part, but trust matters. Trust isn’t only integrity; it’s ability and reliability too. After many centralized failures, trust erodes. And with regulation improving only gradually skepticism remains high.

The philosophical divide between DeFi and TradFi is clear, but market behavior reveals deeper nuance. Where TradFi or CeFi succeed in co-opting crypto, (meaning tools from original ethos DeFi), it’s largely crypto’s fault with its still user challenging environment. Yet still we’re seeing DeFi showing a growth spurt versus Centralized Exchanges (CEXs). It feels like watching people decide the climbing wall is less risky and has more value than taking an elevator, even though DeFi is adding more handholds. (OK, I maybe need to work on that metaphor, but there you go.)

Is Original Crypto Ethos Still Alive?

Somewhat. New, easier solutions drift from purist ideals, but they’re arguably necessary for scale. Mass-market users don’t care about ideology; they care about yield and avoiding abuse. (Though fraud has obviously shown up to crypto’s party too, which is a valid reason to drift towards DeFi, for at least some percentage of portfolio.) Despite this growth, purist DeFi still struggles to cross the chasm from early adopters to the early majority for all the obvious reasons. CeFi is looking more like the bridge.

TradFi is adopting parts of crypto: stablecoins, tokenized assets, blockchain settlement, but not the full stack. The hybrid, dubbed CeFi (Centralized Finance), is a poor label yet a practical reality. “Centralized” contradicts crypto ethos with custodial risk and trust dependencies, but bridges usability and familiarity. Mainstream users will trade sovereignty for convenience; most care more about safer, accessible access to crypto assets.

The Real Battle: Adoption, Not Ideology

DeFi may be rising, but TradFi and its hybrid offspring, CeFi, will capture share unless DeFi solves core weaknesses. Early crypto said, “TradFi will adopt us because people are desperate for an escape route.” The reality may be: TradFi is absorbing crypto because crypto fails mass adoption. TradFi has deep flaws; slow settlements, opaqueness, abuses like naked shorting, but as much as users would prefer better, they tolerate – for now – because the pain is familiar and buffered by safety nets. DeFi, by contrast, demands tech effort and risk. Yet more are still taking that plunge.

The libertarian dream of self-sovereign finance isn’t dead. Though early advocates were aloof, not bridging ideology and usability. Institutions, meanwhile, have resources to abstract away friction, packaging crypto in cleaner UX and trusted brands. This ease may come at expense of independence. DeFi’s growth may be impressive, yet climbing from a small base. Like early internet before TCP/IP got comfortably stuffed into Windows 95, it remains too technical for many users.

Top Three Ongoing Challenges

Following are some top challenges. DeFi’s recent surge makes them more relevant. Wallet growth is real, but new ones drift from pure decentralization in favor of usability. That tradeoff may be the only way the industry levels up. Crypto purists may lament this given CeFi undermines core principles that motivated crypto: centralized custody, opaque operations, regulatory capture, and more. However, after more than a decade, no one has come along with DeFi purist methods that solve these intractable consumer issues.

1. UI / UX: Still User-Hostile

Despite billions invested, crypto interfaces remain confusing, techie, and anxiety-inducing.

- Wallet anxiety: Fear of sending to the wrong address or losing funds.

- Transaction opacity: Unclear fees, delays, and cryptic confirmations.

- Fragmented ecosystems: Each chain, bridge, and wallet behaves differently.

- Easy Self Sovereign Key Management and Recovery: Smart-contract wallets, multi-sig recovery, and social backup methods help, but each adds attack surface or trusted authority. True self-custody remains fragile. “Keyless” wallets trade sovereignty for safety. That tension defines crypto’s usability wall. Though some have made compromises and progress. (See Zengo’s MPC Wallet as one example.)

2. The Crypto Ghost Problem

Billions in coins remain locked forever because owners lost keys, died, or disappeared. Crypto has no account-recovery framework balancing decentralization and survivability. Multi-sig accounts and composable contracts might help, but they’re still complex.

- No continuity of ownership: Estates or partners can’t reclaim funds; impaired users may lose access. Purists call this a feature. Tell that to surviving spouses and kids.

- Business impact: Projects and companies die if founders lose access.

- Human angle: People become “ghosts” with wealth trapped forever on-chain.

The blockchain never forgets, but it doesn’t forgive neglect either. Somewhere, a stablecoin used for on-ramping still earns yield for its issuer. That’s value abandoned by the originator forever, like unspent transit cards. Efforts to simplify recovery inevitably reintroduce central authority. That might no longer be pure DeFi, but it’s preferable for many users.

3. Real and Perceived Risk With No Recourse

Crypto’s last consumer hurdle is trust. Not in the math, but in the absence of safety nets. Self-sovereignty sounds empowering until something goes wrong.

- If you’re hacked, it’s gone.

- If the exchange fails, you’re unsecured.

- If a new project “rug-pulls” good luck finding anyone to sue.

These risks may be inherently unsolvable under decentralization. The same traits that make crypto “trustless” also make it unforgiving. Those uncompromising qualities are what traditional finance is now re-packaging with recovery paths, insurance, and guardrails to make crypto exposure safer for the masses.

Conclusion: It’s Not a Tech Problem, It’s a Human Problem

Crypto is advancing, but next breakthroughs must be human-centric with sensible recovery, better UX, legal-tech bridges, and design for safety. Until then, pure DeFi stays a feral frontier appealing to the technically adept and thrill-seekers but not to everyday users.

People have said this for years, yet billions and brilliant engineers haven’t solved it. History offers perspective: personal computers and the web only scaled when complexity was hidden. Maybe DeFi will follow that curve. The open question: Will DeFi solve its pain points faster than CeFi or TradFi make them irrelevant?

Secondary Issues

Each of these could be solved technically, but collectively show how hard it is to make crypto feel safe. The fixes require better code, regulation, and a little humility.

- Volatility and Unstable Value Anchors

- Mental Overhead / Cognitive Load

- Regulatory Ambiguity

- Scams, Phishing, and Social Exploits

- Fragmentation and Interoperability Fatigue

- Missing Identity and Legal Integration

Product Management and Marketing Lessons

We know ideology can spark a market but rarely sustains it. Sustained markets require habit, trust, and value. Consumers buy into beliefs once; they stay for benefits.

Products win by solving real problems while minimizing friction. Early adopters tolerate hassles, but mainstream users only out of necessity until they find something better. Crypto’s founding ethos of decentralization inspired a movement, yet its refusal to prioritize experience left the door open for TradFi and CeFi. The user never came first, except insofar as they accepted what others decided was best for them.

The enduring lesson for builders is simple: if your vision depends on users adapting to you, then you risk losing to competitors who adapt to them. Consider Nvidia. Early on, they nearly collapsed trying to force its newest tech on markets. CEO Jensen Huang realized survival meant fitting into existing industry structures first, not reshaping them. (See: The Nvidia Way: Jensen Huang and the Making of a Tech Giant – Chapter 4: “All In”) That shift, from demanding adaptation to enabling it, led Nvidia’s rise. Apple’s vision was prescient, but would it have pushed through if it hadn’t embraced some standards; like MS Office? Google didn’t create a mobile OS like Apple’s, but the most adoptable one. Apple may still command best margins, but which OS has more units? We could keep going. The point is idealism is great. Longevity requires some pragmatism and market strategy.

TradFi and CeFi are applying the same playbook of consumer service. They’re not trying to win through ideology, but by making crypto boring, safe, and easy. Everyone wants to build the next great disruption. However, there’s such a thing as being too disruptive. Many “first movers” fail for exactly that reason: they discover a real market need but overshoot what people can practically adopt. Crypto’s story is another reminder that world-changing technology isn’t enough; it must also fit the world that exists.

Additional Reading & References

- DEX Trading Volume Explodes: A Staggering $613.3 Billion Record in October

- TradFi vs. CeFi vs. DeFi

- Centralized Exchange Risk and the Trust Deficit: How Transparency Can Stabilize Crypto Markets

- The Dark Side of Altcoins: Collusion, Price Manipulation, and the CEX Problem

- The Great On-chaining: How CEXs Are Blurring the Lines with DeFi to Define the Future of Crypto

- DEX-to-CEX ratio hits new high as crypto traders flee centralization

- The 2025 Global Adoption Index

- DEX Achieves 25% Market Share: When Will It Overtake CEX?

- DEX Appeal: The Rise of Decentralized Exchanges

- Non-Custodial Wallets 2025 to Grow at XX CAGR with XXX million Market Size: Analysis and Forecasts 2033

- Are Users Pivoting to DeFi Trading? A Closer Look Into CEX Vs. DEX Numbers

- Gate Research: The Ecosystem Landscape and Convergence Trends of CEXs and DEX